xpeng auto stock forecast 2025

Forget Nio and XPeng. XPeng Inc - ADR stock price has been showing a declining tendency so we believe that similar market segments were not very popular in the given period.

Will Xpeng Stock Reach 100 By 2022

However the key challenge is whether the company can sustain this growth for the next three years.

. The average XPENG stock price prediction forecasts a potential upside of 13033 from the current XPEV share price of 2311. The past four quarters have shown a gradual increase in reported sales with a quarterly 3022 growth and an annual growth of 248. Averaged XPeng stock price for month 2152.

XPEV share price prediction for 2022 2023 2024 2025 2026 and 2027. XPeng stock price predictions for May 2023. Ocugen Stock Forecast 2022 2023 2024.

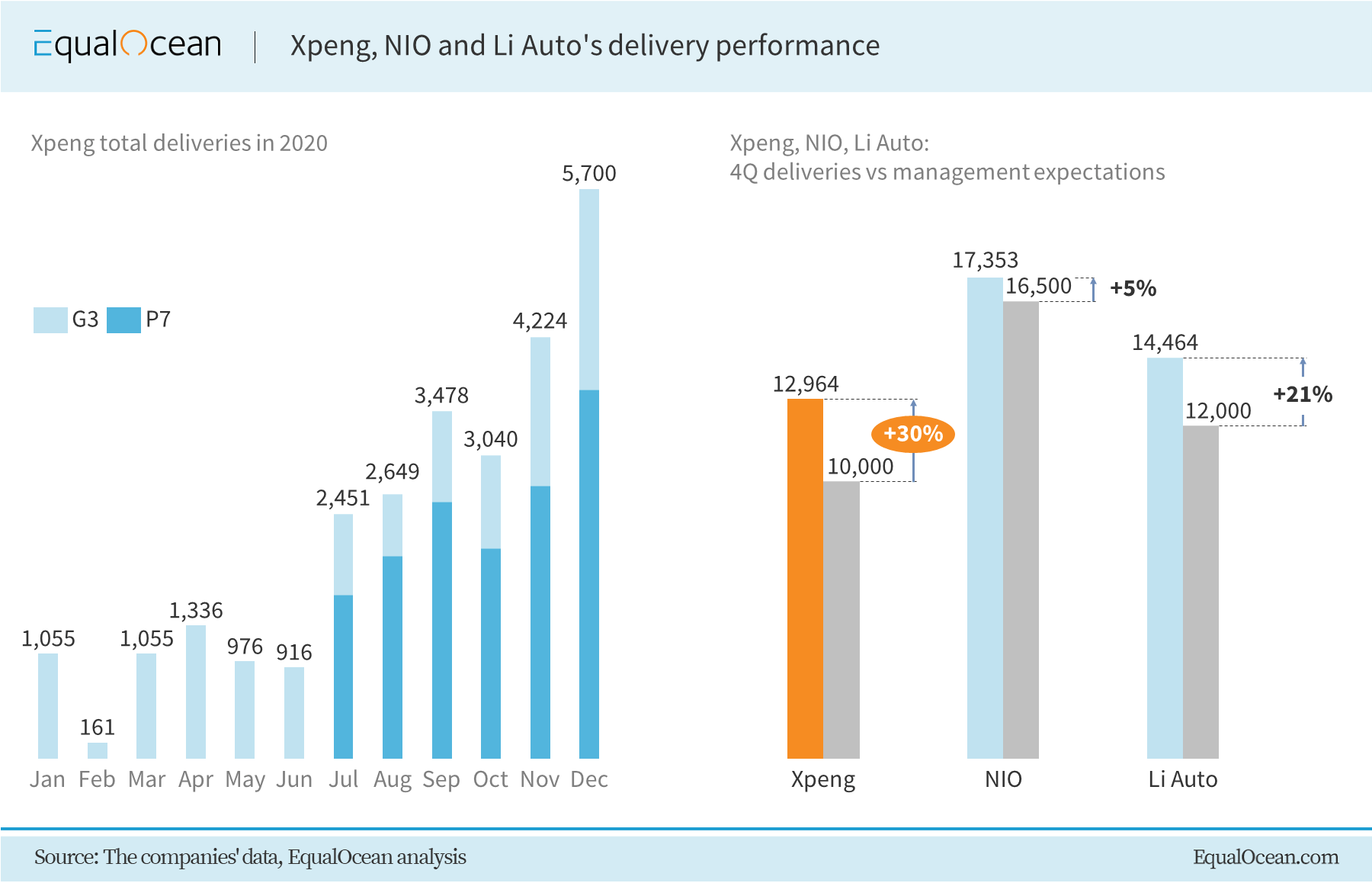

Li Auto LI 1231 was. The Xpeng stock forecast 2025 looks positive on paper if the sales growth figures are the basis for such an outlook. XPeng Stock Forecast 05-15-2022.

XPeng stock predictions for June 2023. XPeng stock price stood at 2672. We surveyed a group of over 200 Benzinga investors on whether shares of Xpeng NYSE.

XPeng will rise to 70 within the year of 2024 80 in 2025 90 in 2026 100 in 2027 and 125 in 2031. XPEV or Li Auto NASDAQ. XPeng Inc Stock Price Forecast for 2025.

Youll find the XPeng share forecasts stock quote and buy sell signals below. The average XPeng stock forecast 2025 represents a -1087 decrease from the last price of 231100006103516. Hong Kong Stock Market Finance report prediction for the future.

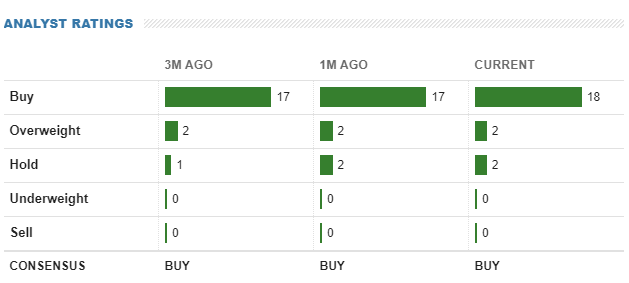

Notably Xpeng Motors has among the highest percentage of buy recommendations in the pure-play EV stock universe. Bitcoin Price Prediction 2022 2023-2025. 5 Stocks Set to Double Each was hand-picked by a Zacks expert as the 1 favorite stock to.

How is XPEV forecast to perform vs Auto Manufacturers companies and vs the US market. Motor Vehicles Car Bodies Industry. This is not an easy task considering Tesla is the current market leader and Nio is already way ahead of XPeng in terms of annual.

XPeng has received a consensus rating of Buy. March 13 2021 at 311 pm. Xpeng is one of China.

Target values for the price of one XPeng share for May 2025. XPeng Inc - ADR Stock Price Forecast for 2025. The forecast for beginning of May 2074.

Heres where things stood for these three stocks as of 2 pm. So stay invested in XPeng if you already hold the stock and dont miss the opportunity to buy any dips. As of 2022 May 09 Monday current price of XPEV stock is 22280 and our data indicates that the asset price has been in a downtrend for the past 1 year or since its inception.

Their forecasts range from 3700 to 6700. March 12 2021 at 117 am. To sum up Xpengs 2022 revenue is projected to reach USD 43 billion CNY 28 billion.

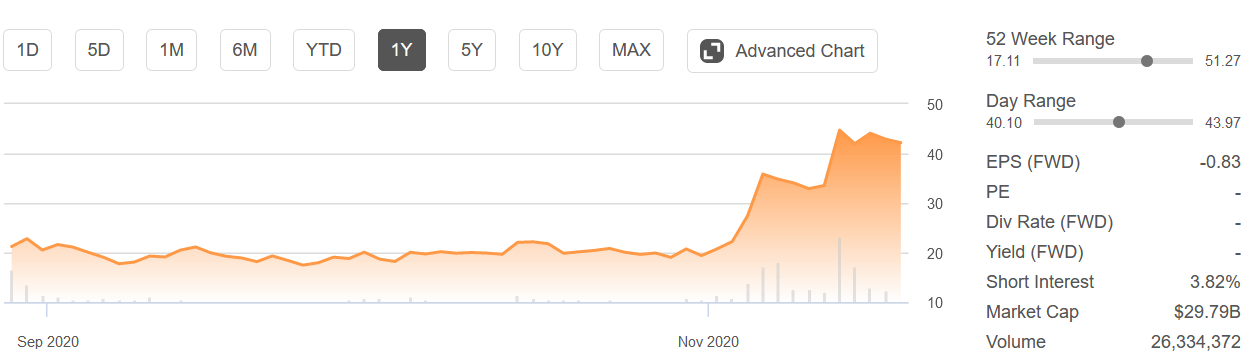

XPengs PB value TTM is currently 260 compared to 261 for Tata Motors 290 for Li Auto and 404 for Nio. According to the latest long-term forecast XPeng price will hit 30 by the end of 2022 and then 50 by the end of 2023. Forecast target price for 05-15-2022.

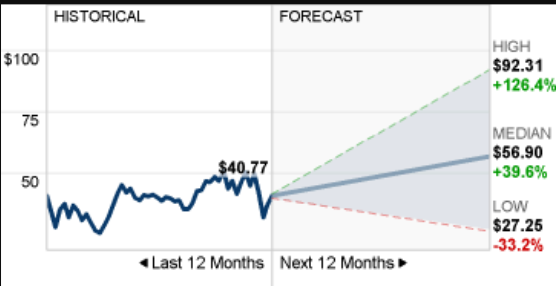

Price at the end 2178 change for May 501. Its street high target price of 7191 is a premium of over 100 while the street low target price of 2714 is a discount of 236. About the XPeng Inc.

Maximum value 2309 while minimum 2047. XPeng stock monthly and weekly forecasts. The 25 analysts offering 12-month price forecasts for Xpeng Inc have a median target of 4172 with a high estimate of 6506 and a.

This compares to the year-ago revenue of 26247 million. 64th out of 139 stocks. Kandi Technologies Group KNDI 390 was up about 99.

The weighted average target price per XPeng share in May 2025 is. Negative dynamics for XPeng shares will prevail with possible volatility of 3175. For XPeng stock forecast for 2025 12 predictions are offered for each month of 2025 with average XPeng stock forecast of 206 a high forecast of 2167 and a low forecast of 1978.

LI stock would grow the most by 2022. For XPeng stock forecast for 2027 5 year 12. 11 brokerages have issued 12-month price objectives for XPengs stock.

The company also issued a strong fourth-quarter outlook. What is XPEVs Earnings Per Share EPS forecast for 2022-2024. In May the positive dynamics for Momo shares will prevail with possible monthly volatility of 12500 volatility is expected.

This company and Tesla will be the top two electric-vehicle plays by 2025 says UBS. 18th out of 42 stocks 5 - 4 - 3 - 2 - 1 - 45 Analysts Opinion. According to the Streets expectations the stock is priced at 16 88 56 4 29 forward PS ratios by 2025.

Revenues climbed 1464 year-over-year and 217 sequentially 6666 million. XPEV one year forecast. XPeng must compete with Tesla Nio Li Auto and BYD for revenue.

However the caveat is that Tata Motors has over US1296BN in net debt compared. Specifically the company will sell 122253 vehicles to make USD 41 billion topline and USD 025 billion will be from other services. XPEV stock price predictions 2022 XPeng Inc - ADR stock forecast XPEV forecast tomorrow XPeng Inc - ADR technical analysis XPEV stock future price XPeng Inc - ADR projections XPeng Inc - ADR market prognosis XPEV.

EST relative to their closing prices on Monday. The stocks median target price of 5484 is a 543 upside over the next 12 months.

Xpeng Stock 17x Potential By 2025 Youtube

Xpeng Stock Forecast For 2022 2025 Is The Rally Sustainable

Xpeng Stock Forecast For 2022 2025 Is The Rally Sustainable

Xpeng Vs Nio Which Ev Stock Is The Better Buy Nyse Nio Seeking Alpha

Xpeng Stock Forecast For 2022 2025 Is The Rally Sustainable

A Look At Xpeng A Potential Rising Star In The Electric Vehicle Market Nyse Xpev Seeking Alpha

Xpeng Nyse Xpev Pulls Off A Successful 1 5 Billion Ipo As Scorching Demand Prompts The Company To Raise The Offering Size The Stock Commences Trading At 23 10

Like Nio Like Tesla Xpeng Is Another Parabolic Ev With Future Potential And A Hefty Valuation Nyse Xpev Seeking Alpha

Xpeng Stock Forecast For 2022 2025 Is The Rally Sustainable

Xpev Xpeng Inc Adr Stock Overview U S Nyse Barron S

Like Nio Like Tesla Xpeng Is Another Parabolic Ev With Future Potential And A Hefty Valuation Nyse Xpev Seeking Alpha

Xpeng Nyse Xpev Pulls Off A Successful 1 5 Billion Ipo As Scorching Demand Prompts The Company To Raise The Offering Size The Stock Commences Trading At 23 10

Xpeng Strong Growth Momentum Buy Signal Emerges Nyse Xpev Seeking Alpha

Xpeng Launched By Chinese Ev Maker Upgraded Semi Autonomous Driving Features In A Challenge To Tesla The Balkantimes Press

Why Is Xpeng Motors Stock Falling And Will Xpev Go Back Up

Nio Stock Forecast 2022 Nio Deliveries Crash Due To Covid Target Price At 46 Lower Crowdwisdom360